Judul : Financial authorities accelerate delisting of 60+ insolvent firms

link : Financial authorities accelerate delisting of 60+ insolvent firms

Financial authorities accelerate delisting of 60+ insolvent firms

On the 15th, while the Korean stock market, including the KOSPI breaking the 3,400-point mark for the first time in history, is rising, the number of companies delisted and disappearing from the market is also increasing. According to the Korea Exchange, the number of companies delisted this year has reached around 60. Analysis suggests that as financial authorities began a large-scale cleanup of insolvent companies this year—including strengthening listing eligibility review standards—the number of companies failing to meet requirements and leaving the stock market is growing.

◇This Year’s Delistings Exceed 60 Cases

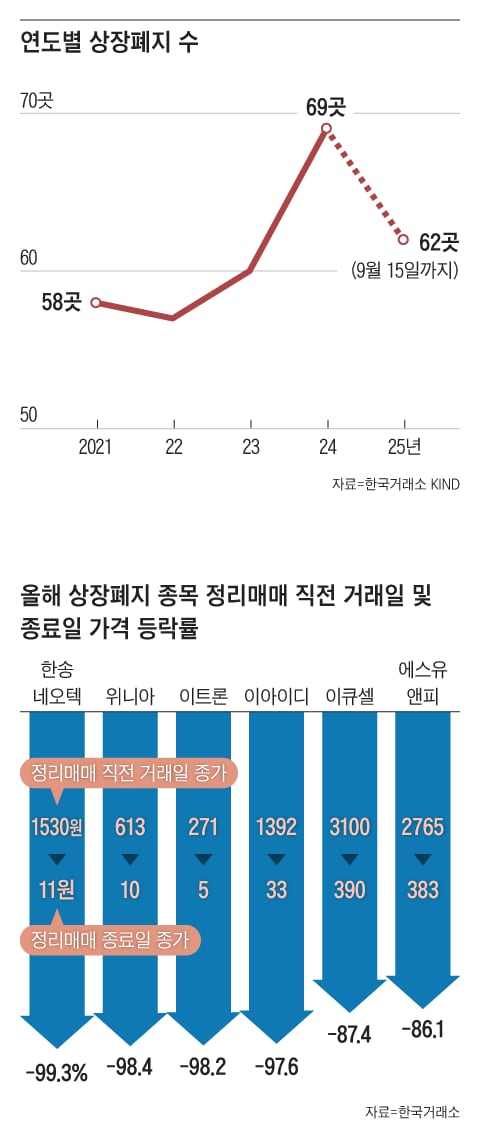

According to the Korea Exchange on the 15th, 62 companies were delisted from the Korean stock market from the beginning of the year to the 15th. Last year saw 69 annual delistings, and in 2023, 60 companies were delisted in a single year. This year, even when counting only up to the third quarter, the number has surpassed 60. Excluding SPAC (Special Purpose Acquisition Company·a listed company established to help unlisted companies go public) delistings or transfers, 32 companies were delisted this year—higher than the same period last year (26). The number of companies designated as management-targeted stocks has also increased. Management-targeted stocks are designated by the Korea Exchange to warn investors when a listed company has serious financial or management issues or is likely to fail to meet listing maintenance criteria. A total of 55 companies were designated as management-targeted stocks this year.

◇Government Accelerates Cleanup of Insolvent Companies

The notable increase in corporate delistings this year stems from the listing eligibility review system reform announced by financial authorities earlier this year. The reform focuses on strengthening criteria for companies to maintain listing—such as market capitalization and sales—and simplifying delisting procedures. For KOSPI-listed companies, the current market capitalization threshold of over 5 billion Korean won will gradually rise to 50 billion Korean won by 2028. The sales threshold will increase to 30 billion Korean won by 2029. For the KOSDAQ market, the market capitalization threshold will strengthen from 4 billion to 30 billion Korean won, and sales from 3 billion to 10 billion Korean won. Audit opinion requirements have also tightened: companies receiving a "non-unqualified" audit opinion for two consecutive years face immediate delisting. The improvement period for KOSPI-listed companies—previously up to four years—has been reduced to two years. For KOSDAQ, the review process has shifted from a three-stage to a two-stage system, and the improvement period has shortened from two years to one and a half years. According to a report by the Capital Market Research Institute, approximately 8% of securities market companies and 7% of KOSDAQ companies as of last year could become delisting targets under the reformed financial criteria. President Lee Jae-myung recently reiterated the need to clean up insolvent companies to revitalize the KOSDAQ market, leading to forecasts that delisting pace for non-compliant firms will accelerate.

◇Average Decline Rate in Delisting Auctions Reaches 91%… Investors Must Exercise Caution

While cleaning up insolvent companies to revitalize the capital market is inevitable, there are calls to minimize market shocks during delisting and strengthen investor protections. Particularly, during delisting auctions for confirmed delisted stocks, trading occurs at excessively low prices compared to existing stock prices, necessitating investor caution. Delisting auctions provide shareholders holding delisted stocks with a selling opportunity. However, price limits do not apply during this period, attracting short-term speculators and increasing volatility, which could lead to investor losses—a criticism that persists. Calculations by this newspaper of 21 companies delisted from the securities and KOSDAQ markets (excluding SPACs and voluntary delistings) from early this year to the 15th show an average decline rate of 91% from the day before auctions began to the last day. Fifteen companies saw declines exceeding 90%. Recently, stocks related to the so-called "E-Group"—including Ewha Electric, E-ID, and E-Tron—were delisted after their stock prices fell by an average of 84% during auctions.

Researcher Lee Sang-ho from the Capital Market Research Institute stated in the report, “When delisting so-called asset stocks (stocks with a market capitalization lower than the company’s held assets) traded below liquidation value, there is a particularly high possibility of auctions occurring at excessively low prices.” He added, “While considering measures to activate mergers and acquisitions, it is also necessary to establish institutional mechanisms to protect the rights of general shareholders during the delisting process.”

※ This article has been translated by Upstage Solar AI.

Demikianlah Artikel Financial authorities accelerate delisting of 60+ insolvent firms

Anda sekarang membaca artikel Financial authorities accelerate delisting of 60+ insolvent firms dengan alamat link https://www.angkaraja.cfd/2025/09/financial-authorities-accelerate.html

0 Response to "Financial authorities accelerate delisting of 60+ insolvent firms"

Post a Comment